A Biased View of Financial Advisor Brisbane

Table of ContentsMore About Financial Advisor BrisbaneSee This Report about Financial Advisor BrisbaneSome Known Facts About Financial Advisor Brisbane.Our Financial Advisor Brisbane IdeasSome Known Details About Financial Advisor Brisbane

Financial organizers aren't just for the affluent. They can assist those of even more moderate methods to find out a means to fund their children's college education and learnings, to intend for retired life, or to make sure that their IRS bills are as manageable as possible. They can help you invest carefully if you have some money left over after seeing to these issues.It can consist of: Assist with one monetary issue, for example, just how much to add to your super, or what to do if you inherit shares. Assist to create a financial plan to reach your monetary goals.

Once you understand what you desire, find an adviser who uses the ideal solutions for you. Financial Advisor Brisbane. You can find a licensed economic adviser through: a financial advice professional organization your incredibly fund your loan provider or financial institution suggestions from people you recognize Browse by postcode on the economic advisors register to locate an accredited adviser near you

The Best Guide To Financial Advisor Brisbane

The ideal way to see what a financial adviser offers is to read their Financial Services Guide (FSG). Look for this information on their site or ask them for a duplicate.

Robo-advice may be less expensive and much more convenient than a financial consultant, yet it has limitations. It can't address your inquiries, and it can't give you advice concerning complicated financial scenarios.

This makes it very easy to meet a few various consultants to contrast what they provide. When you meet a consultant, ask about: their qualifications, primary client base, and specialty locations what fees you will pay, exactly how frequently and what you'll obtain in return exactly how they'll manage your money how commonly you'll meet what details you'll get and how often exactly how they'll consult you on decisions just how they'll keep track of and handle your investments what payments or rewards they receive if they offer an economic product, and how they'll choose products to suggest to you who'll care for your account when they're away how they'll take care of complaints (see issues with a monetary consultant to find out about the issues process) exactly how to finish your arrangement with them (including any type of fines or notice durations) A great consultant will certainly be familiar with you, keep you notified, and aid you attain your objectives.

The smart Trick of Financial Advisor Brisbane That Nobody is Discussing

Read on to recognize much more. A financial advisor is a proficient expert specialising in financial preparation, financial investments, and riches administration, possessing characteristics such as solid logical skills, excellent interaction, thorough financial knowledge, moral conduct, a client-centric strategy, flexibility to market modifications, regulative conformity, analytical aptitude, critical preparation ability, and a continual knowing state of mind.

The obligations of why not check here a financial consultant encompass a large spectrum of financial solutions and customer demands. The role of a monetary expert is to provide customised economic advice.

Beneficiary Designations: They make sure that recipient designations on retired life accounts, insurance plan, and various other possessions straighten with the customer's estate plan. Minimising Probate: Advisors assistance clients structure their estates to reduce the influence of court of probate process and associated costs. The benefits of a financial consultant include retired life preparation and revenue monitoring.

4 Simple Techniques For Financial Advisor Brisbane

In our interconnected world, monetary experts may require to take into consideration worldwide investments, tax implications, and estate preparation for customers with global assets or passions (Financial Advisor Brisbane). Remaining informed about global financial markets and laws will be vital. Embracing electronic platforms and tools for customer interactions, profile administration, and monetary preparation is ending up being vital

Selecting a fiduciary expert can offer extra confidence that their suggestions are in your favour. Demand recommendations from existing or past clients to obtain a feeling of the advisor's efficiency and customer complete satisfaction.

To navigate the intricacies of the financial globe you can get to out to Share India. Yes, the majority of financial experts require to be certified and may hold accreditations Yes, monetary consultants can offer assistance on managing and decreasing debt as part of a comprehensive financial strategy. Several economic experts use tax planning advice as component of their solutions, aiding customers optimise their finances while reducing tax obligation obligations.

A Biased View of Financial Advisor Brisbane

The timeline for Australian financial solutions (AFS) licensees and financial consultants to abide by the professional criteria is set in the anonymous Firms Act. For what to do by when, see Timeline for the reforms. On 28 October 2021, the Financial Industry Reform (Hayne Royal Payment Action Better Suggestions) Act 2021 (Much Better Advice Act) moved functions associating to the reforms from the Financial Adviser Specifications and Ethics Authority (FASEA) to the Minister and to ASIC.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Traci Lords Then & Now!

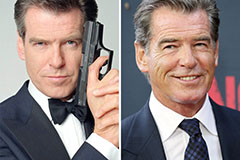

Traci Lords Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!